Not Sure How Many Solar Panels You Need?

Try our Power Consumption Worksheet.

Make a copy of the worksheet and update with your information.

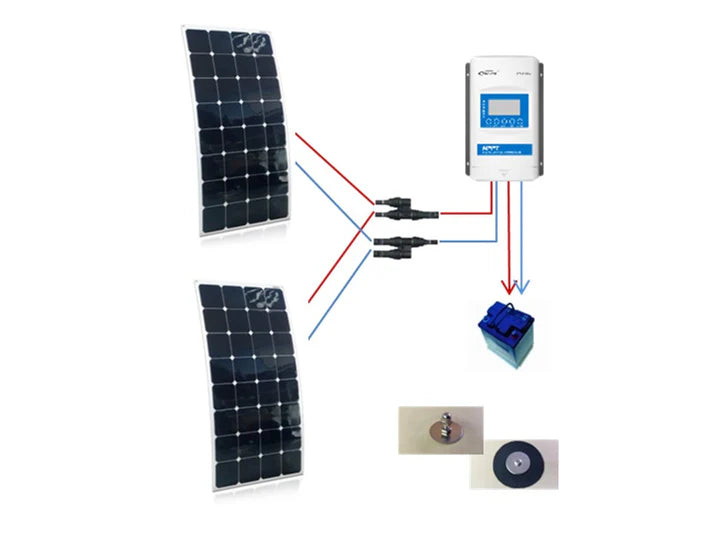

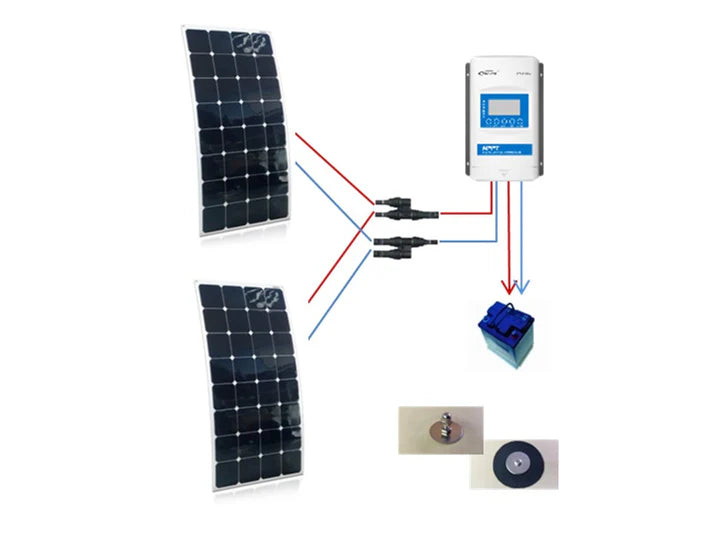

Wiring Diagrams

Table: Solar Panel Wattage Range vs. Appropriate Controllers

See All Solar Panel Specifications

Federal Solar Tax Credits Extended

Federal Solar Tax Credits Extended

Good News for Solar Enthusiasts: Now Extended Through 2034!

The Inflation Reduction Act of 2022 has extended the Federal Solar Tax Credit (ITC), giving homeowners and boat owners even more incentive to go solar. This tax credit applies to your primary or secondary residence—including certain boats with living accommodations (head, galley, and bunk) registered in the U.S.

What You Need to Know

Tax Credit Rate:

- 2022–2032: 30% of total system costs

- 2033: 26% of total system costs

- 2034: 22% of total system costs

- After Jan. 1, 2035: 0%

Eligibility:

You can claim this credit if you’ve made energy-saving improvements to your home (or qualifying boat) in the U.S. during the tax year. Qualified residences include:

- Houses

- Mobile homes

- Condominiums

- Cooperative apartments

- Houseboats (with proper accommodations)

What’s Covered:

The credit applies to the cost of:

- Solar panels

- Batteries

- Inverters

- Charge controllers

- Wiring and labor costs

Retroactive Eligibility:

Systems placed in service after January 1, 2006, can qualify if the credit hasn’t already been claimed.

Unused Credits:

If your tax liability is lower than the credit, you can roll over unused amounts to future tax years.

How to Claim the Credit

- Complete IRS Form 5695:

Download the form here. Make sure to use the latest version updated in January/February of the applicable tax year.

Instructions for Form 5695. - File with IRS Form 1040:

The total from Form 5695 is entered as a line item on Form 1040. Attach both forms when filing your return.

Download IRS Form 1040.

Additional State Incentives

Many states offer additional tax incentives or rebates for solar energy systems. Check out the Database of State Incentives for Renewables & Efficiency (DSIRE) for a detailed breakdown of state-specific programs.

State Highlights

- Arizona: 25% tax credit, up to $1,000.

- Hawaii: 35% tax credit, up to $5,000.

- New York: 25% tax credit, up to $5,000.

- Oregon: Up to $6,000 in credits over four years.

- South Carolina: 25% tax credit for installation costs.

Note: State programs are subject to change. Always verify details with your state’s tax department.

Don’t Wait—Take Advantage of Solar Savings!

With the credit extended through 2034 and now covering batteries, it’s the perfect time to upgrade or install a solar system. Be sure to consult your tax advisor to maximize your savings and ensure compliance with the latest regulations.

Free Shipping!!!

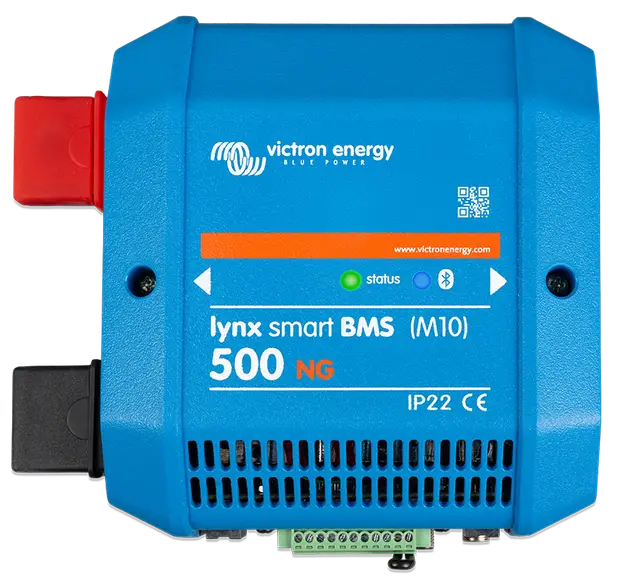

The Lynx Smart BMS NG is an advanced Battery Management System specifically designed for Victron Energy Lithium NG batteries (not to be confused with the Lynx Smart BMS, which is for Victron Lithium Battery Smart batteries). This robust BMS ensures seamless performance, optimal safety, and efficient monitoring for Lithium NG battery banks, which are available in nominal voltages of 12.8V, 25.6V, and 51.2V with various capacities.

The battery systems can be configured in series, parallel, or a combination of both, supporting 12V, 24V, and 48V systems. Each system can accommodate up to 50 batteries, offering up to 192kWh (12V) or 384kWh (24V/48V) of energy storage. By paralleling multiple Lynx Smart BMS units, you can expand capacity and ensure redundancy.

Key Features:

- Built-in 500A Contactor: Provides fallback safety and enables remote-controlled main system switching.

- Battery Monitoring: Displays state of charge and other vital data for efficient system management.

- Pre-Alarm Signal: Alerts before system shutdown due to low cell voltage

- Bluetooth Connectivity: Easily set up, monitor, and diagnose the system from our VictronConnect App.

- Local & Remote Monitoring: Compatible with Victron GX devices, like the Cerbo GX, and the VRM portal for real-time monitoring.

- M10 Busbar Integration: Seamlessly connects to all Lynx M10 products, ensuring smooth integration into the Lynx Distributor system.

The Lynx Smart BMS NG is an integral part of the modular Lynx Distribution system.

Victron Part # LYN034160310

Solar System Design and Installation

We have put together a collection of helpful information for our customers on everything to help you design you perfect system and installation instructions.

Show Me How to Put Together My System

Premium Marine Solar Panels/Systems and Lithium Iron Batteries

Improve your cruising experience with the highest efficiency solar panels available.

Learn More

Popular Collections

- Your collection's name

Marine Solar Panels

- Your collection's name

Solar System Kits

- Your collection's name

LiFePO4 (Lithium Iron Phosphate) Marine Batteries

Shipping

Products ship day after payment domestically. Free shipping on orders over $250 applies to Lower 48 US states only. International takes longer. We do not add tariff charges. Call for pricing.

Custom Designs & Custom Made Panels Available on Request

Our engineers will work with you to design a solar system specific to your needs including Lithium Batteries if you like. (Batteries are 10% off w/ solar system purchase).

If you'd like a custom solar panel, we can do it at $10/watt, more info here: Custom Solar Panels

Call Us: 248-712-1526

Federal Solar Tax Credit

💡 Did you know? You may qualify for a 30% Federal Solar Tax Credit on your marine solar system.

👉 Learn More